Returning a financed car to the Dealer can be like returning a cat to its owner—it’s not always smooth, and you may get scratched. But unlike returning a cat, there are some situations where returning a financed car to the Dealer is jewelry, such as when the vehicle is a lemon or the borrower is facing financial difficulties.

So buckle up and get ready for a bumpy ride as we explore returning a financed car to the Dealer – hopDealer with less meowing and scratching along the way!

Can you return a financed car to the Dealer?

Yes, the Dealer can return a financed car to the Dealer. Still, the Dealer has four possible cases: voluntary surrender, based on lemon law, contract breach-proof, or if the Dealer engagDealerunfair or deceptive practices.

Please read our similar article in detail. Can you return a financed car to the bank?

Returning a financed car to the Dealer is not straightforward and can have significant financial consequences for the borrower. In most cases, a borrower who has invested in a vehicle must pay off the loan in full, regardless of whether or not they decide to keep the car. However, there are some situations in which a borrower may be able to return a financed car to the Dealer:

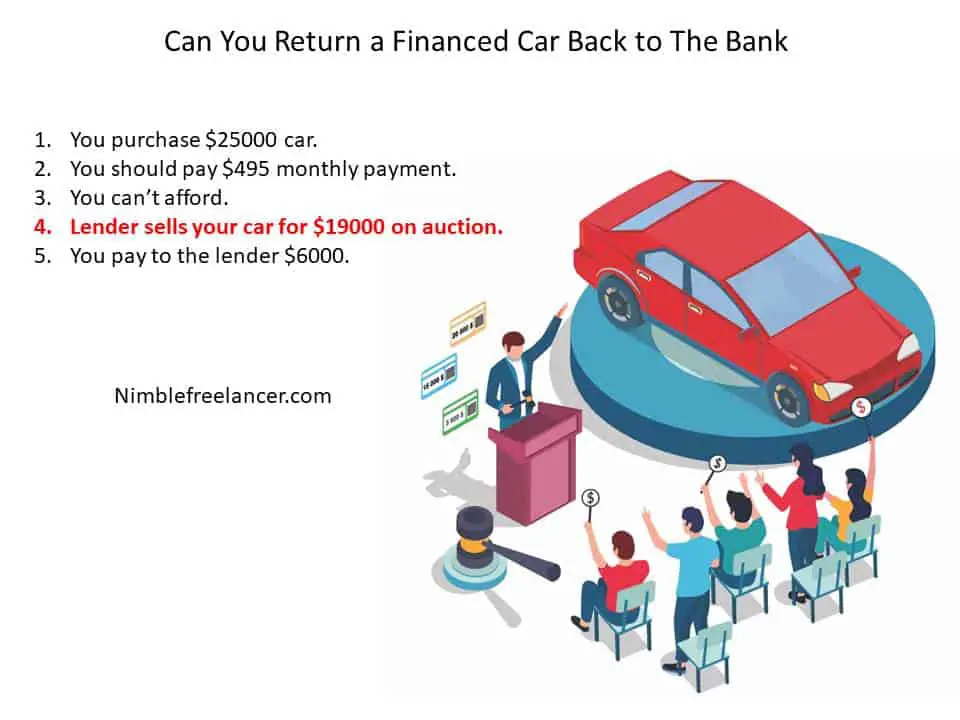

- VoluDealerSurrender: If the borrower can no longer afford to make payments on the car, they may be able to surrender the vehicle to the lender or Dealer volunteer. This is known as voluntary repossession. However, the borrower will still be responsible for any deficiency balance (the difference between what the car sells for at auction and the remaining balance on the loan).

- Lemon Law: If the car has significant mechanical problems that cannot be repaired after several attempts, the borrower may be able to return the vehicle under the Lemon Law. This law requires manufacturers to repair or replace defective vehicles within a reasonable time or provide a refund or replacement vehicle.

- Breach of Contract: If the Dealer or lender has breached the contract, the borrower may have grounds to return the car. For example, if the Dealer promiDealer provides a warranty that was not offered, the borrower may be able to return the vehicle.

- Unfair or Deceptive Practices: If the Dealer engaged in unfair or deceptive practices, such as misrepresenting the condition of the car or the terms of the loan, the borrower might be able to return the vehicle.

Return a financed car to the Dealer with adverse consequences.

Returning a financed car to the Dealer withoDealerancial consequences for the borrower is rare, as most lenders and dealers will require the borrower to pay off the loan in full, regardless of whether or not they decide to keep the car. However, there are some situations in which a borrower may be able to return a financed car to the Dealer withoDealerancial consequences.

One example is if the Dealer or leDealeras has a buyback or return policy. For instance, some dealerships may offer a return policy within a specific timeframe after purchasing a vehicle, such as 30 days or 1,000 miles. Suppose the borrower returns the car within this timeframe and meets the conditions of the policy (such as not having damaged the car or driven it excessively). In that case, they may return the vehicle without any financial consequences, such as fees or penalties. However, it is essential to carefully read and understand the terms of the return policy before purchasing the vehicle.

Another example is if the car has a defect significantly affecting its safety, performance, or value, and the borrower can successfully exercise their rights under state or federal law, for example. Suppose the car has a serious safety defect that cannot be repaired after several attempts. In that case, the borrower may return the vehicle under the federal or state Lemon Law. If the borrower successfully returns the car under these laws, they may be able to recover the amount of the loan paid to date and possibly even damages or other relief. However, these cases can be challenging to prove and may require the assistance of an attorney.

It is important to note that these situations are relatively rare, and borrowers should always carefully read and understand the terms of their loan agreement before signing. In addition, if a borrower is considering returning a financed car to the Dealer, they consult an attorney or financial advisor to understand their options and potential consequences.